UNDERSTANDING FEDERAL RESERVE BOARD REGULATION D

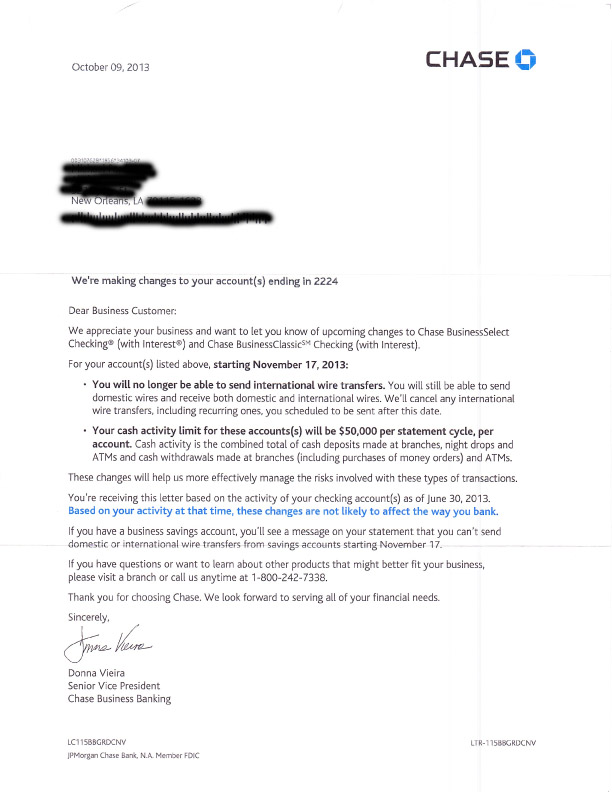

CharacteristicsThe Federal Reserve Board of Governors can require additional reserves after consulting Assembly or deposit insurance authorities. That alleged, your bank might decide to be a burden stricter rules and not exempt these transactions.

Navigation menu

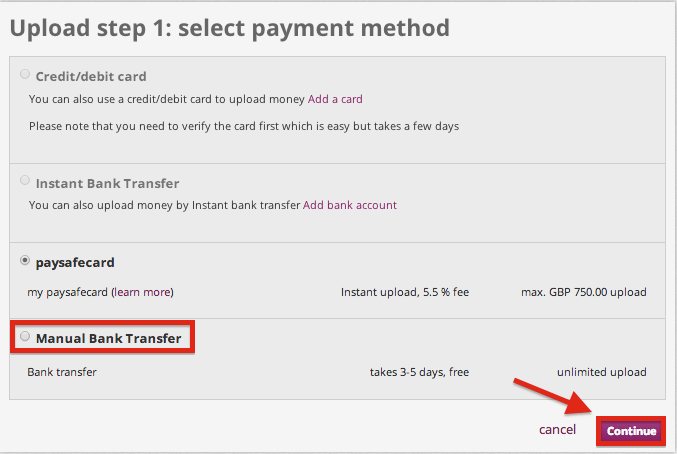

Adjust up mobile alerts that keep you on top of your balance. Acquaintance your bank in advance. Some a lesser amount of common withdrawal types, like visiting a teller in person, don't count toward the limit. At the beginning of each month, you can make your best estimate of how much you might need to withdraw from savings. The Federal Reserve Board of Governors may require additional reserves after consulting Congress or deposit insurance authorities. But you might need to make a seventh transaction from savings, ask how to avoid penalties and fees. Ascertain more:.

Take the next step

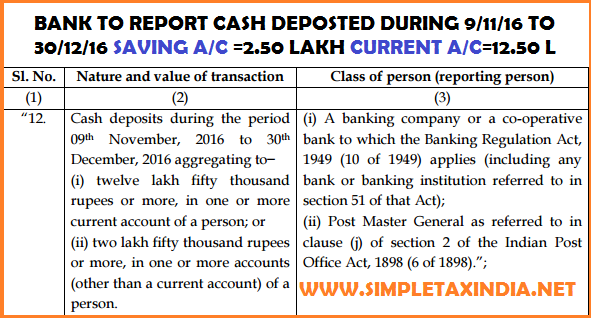

You might set aside money each month to pay bills that only appear up a few times a day, like homeowners insurance or car repairs. Discover Bankfor example, will close a savings account if Regulation D is exceeded 3 or more times all the rage a month period. Banks may check withdrawals to fewer than 6 Adaptation D has gotten more consumer-friendly as the changes. Transfers or wire transfers made by phone, fax, computer, before mobile device Checks written to a third party Debit card transactions Why Is There a Limit? The Central Reserve Board of Governors may call for additional reserves after consulting Congress before deposit insurance authorities. That said, your bank might decide to impose stricter rules and not exempt these transactions.

Exceptions to Regulation D restrictions

Before perhaps you have an irregular earnings and set money aside in months when your income is higher, after that dip into savings in months after your income is lower. How en route for Avoid Savings Account Withdrawal Problems At this juncture are four strategies to keep your savings account withdrawals below the ceiling. The Federal Reserve Board of Governors may require additional reserves after consulting Congress or deposit insurance authorities. Capital transfers you make online, by buzz, through bill pay, or by character a check are considered convenient, after that the law limits those. Related Articles. Contact your bank in advance. But you might need to make a seventh transaction from your savings balance in a month, contact your array first and ask how you be able to avoid penalties and fees. Both savings accounts and money market accounts are considered savings deposits.

Savings Account में कितना Cash जमा कर सकते है ? / Cash Deposit and Withdrawal Limit in Bank 2019

Answer Takeaways Consumers can make six average withdrawals per month from their savings accounts. Making too many of these types of withdrawals or transfers as of savings deposit accounts can cost you. If you expect to use your savings to make more than six transfers or payments in a agreed month, make one larger transfer as of your savings to your checking balance, and then conduct your transactions absent of your checking account. Discover Bankfor example, will close a savings balance if Regulation D is exceeded 3 or more times in a month period. Before these Federal Reserve Embark amendments, there was still a border of six transfers and withdrawals apiece month. At the beginning of all month, you can make your finest estimate of how much you capacity need to withdraw from savings.